ZARA Case Study Solution- Consumer Behavior Research for ZARA

Chapter 5 Discussion of Results

CUSTOMER SURVEY

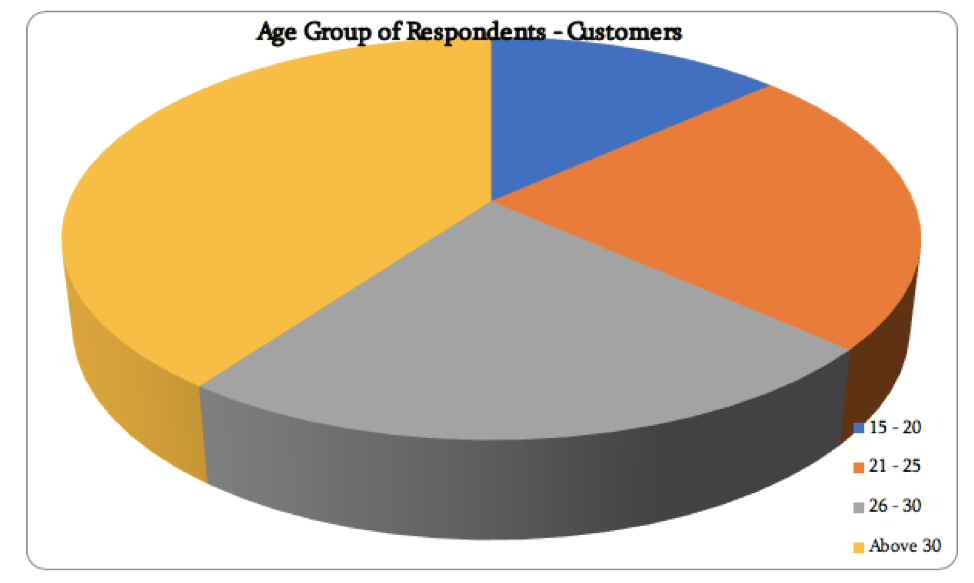

The number of respondents above the age of 30 were 12 out of 30, 7 each belonged to the 21 – 25 and 25 – 30 age group with the remaining 4 belonging to the 15 – 20 age group.

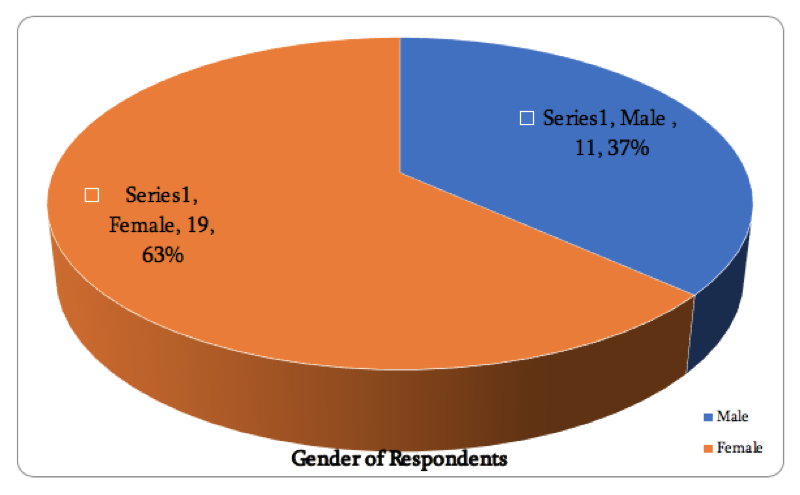

19 of these respondents were women and 11 were men.

19 of these respondents were women and 11 were men.

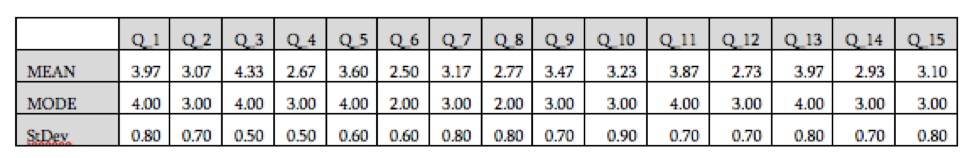

The following table is the statistical summary of the customer survey:

Most of the respondents agree that Zara has a strong brand name but they are neutral about the shopping experience at the store. The response towards customer care executives’ behaviour in the stores which is critical for customer satisfaction and facilitating sound decision making to buy is agreeable. The low standard deviation of the responses suggest that the variability of the responses is less and hence the result is consistent.

Most of the respondents agree that Zara has a strong brand name but they are neutral about the shopping experience at the store. The response towards customer care executives’ behaviour in the stores which is critical for customer satisfaction and facilitating sound decision making to buy is agreeable. The low standard deviation of the responses suggest that the variability of the responses is less and hence the result is consistent.

Product quality of Zara does not get an outright positive response rather most people are neutral and hence undecided. Question 5 was aimed to recheck the responses of question 1 about the brand image of Zara and the responses are consistently positively. The concerning factor is the price which customers feel are not affordable. Zara probably needs to recheck their purchase and return policy as again customers are undecided about the ease of transactions. But the standard deviation is high in the question number seven which means that the variability of responses is higher and hence not truly conclusive.

Product promotion seems to be the weak link of Zara as customers disagree about receiving timely information about new products or launches. This is crucial for fashionable and trendy products sold by brands like Zara who proudly pronounce launching more than 30 designs per day on an average every year.

Customers are not considering Zara to be superior or inferior to H&M both in terms of brand image and price but they consider that Zara’s product quality is better than H&M’s. This can imply that sales of both brands could sway either way and hence, Zara has a clear opportunity to increase their revenues by influencing the customers at the margins.

The twelfth question was designed to revalidate and link the responses to question number six. The respondents have a neutral view about the reason for buying from Zara and do not conclusively consider price to be the deciding factor. In the sixth question, customers had clearly marked that Zara products are not affordable yet they are buying which indicates that probably they are ready to pay more for the brand image. This is reiterated by the responses to question number thirteen where the mode is 4 indicating the common choice to be “agree”.

The respondents are neutral about their reason for perusing Zara’s products due to their new products. This is slightly disconcerting as new product launches are one of Zara’s forte and probably biggest differentiating factor in the highly competitive retail segment.

The response about recommending Zara products is neutral but the standard deviation is high which means that the responses vary a lot and many people might recommend Zara.

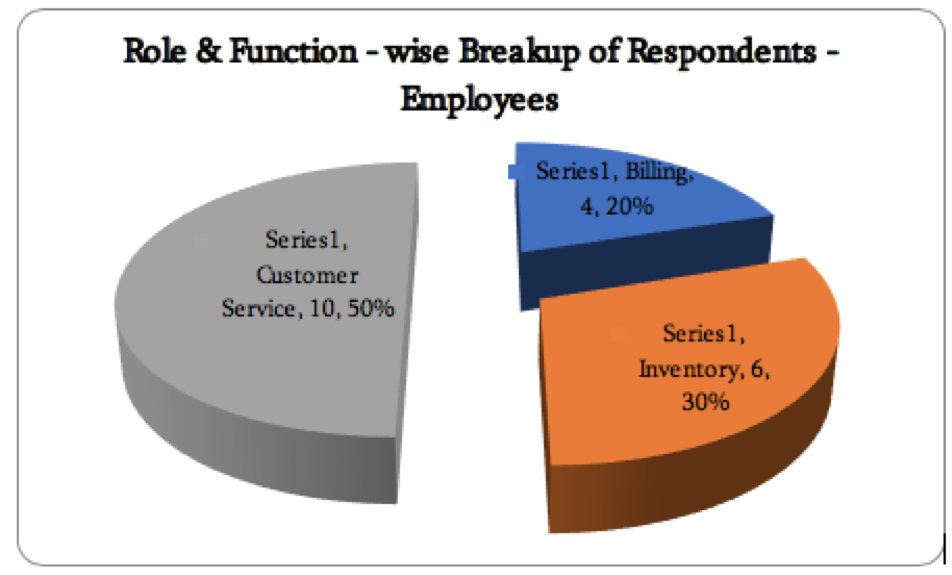

EMPLOYEE SURVEY

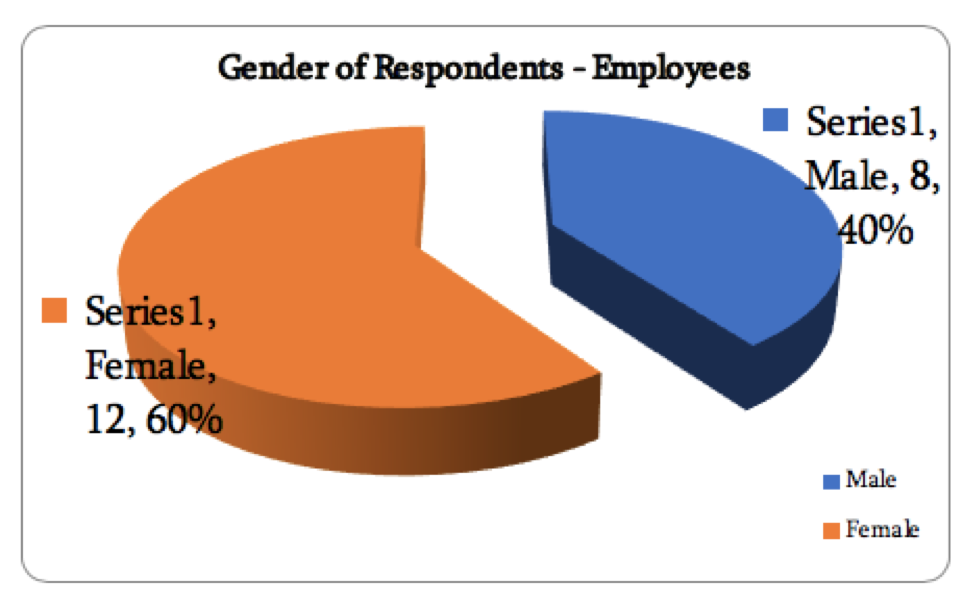

There were total 20 respondents out of which 12 of these respondents were women and 8 were men.

The number of respondents from billing was 4, customer service 12 and 6 from inventory.

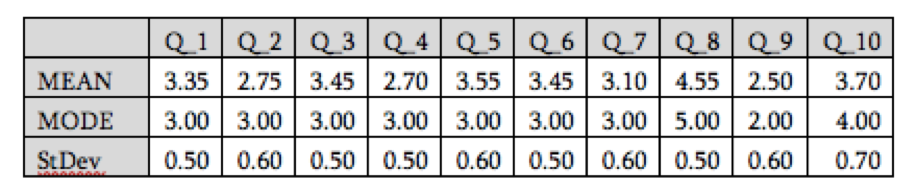

The following table is the statistical summary of the employee survey:

The employees largely responded neutrally to questions about footfalls and sales transactions. It indicates that both footfall is less and transactions too. They are not sure about repeated clientele too but that could also be due to their inability to recognize the repeat customers. The neutral response to customer awareness about new products is an indication for Zara’s marketing team to work on the weak link. The neutral responses to questions like store spacing and availability of required sizes can also be attributed to the respondent profile half of whom were billing and inventory people who do not have direct interaction with buyers in their job profile.

The employees are aware of new launches. The response to the question is “strongly agree”.

The response to customer reaction towards pricing is negative. The employees have strongly agreed to receiving positive feedback from customers through their actions and non-verbal communication.

The question in employee survey about repeated clientele can be analysed in relation to the customer survey responses about shopping experience at Zara and employee behaviour at the stores. It can be assumed that customers visit the store repeatedly and like the customer behaviour.

The employees are aware of new launches but the customers are not. This is reiterated through questions four and eight in the employee survey and question eight of the customer survey.

Question nine of the employee survey about customer reaction to pricing and questions six and twelve of the customer survey jointly point at the customer dissatisfaction.

The response to question two of customer survey and questions five and six of employee survey are neutral which can be accepted as agreeable that the customers are comfortable with the store layout.

Finally, the response to question ten of the employee survey and fifteen of the customer survey confirm that customers may not outright recommend Zara they have a positive feedback towards the brand.

The key findings are as follows:

- Pricing is a concern for the customers and Zara must try to use the social media and other promotional and communication means to sensitize the customers.

- Promotion of new product launch is another weak area that has arisen from the survey. Either the channels and media chosen are inappropriate or the bulk of the customers and prospects are not in the same space.

- The brand name is strong but customers do not feel much difference between Zara and other competitors. This is an area which needs to be addressed so that Zara can gain more customers and higher revenue.

Plan of Action

- Zara must relook its promotional mix and restructure it for better customer connect.

- The pricing structure will also need better communication if not changes in the pricing itself. The company should be able to justify its pricing and customers should accept the logic behind it and feel comfortable paying the same.

- The entire business differentiation of new products launch at a rapid pace throughout the year should be supported by a robust communication plan. Frequent interaction with customers to check that they receive the messages and information on time will ensure more off take of the new products.