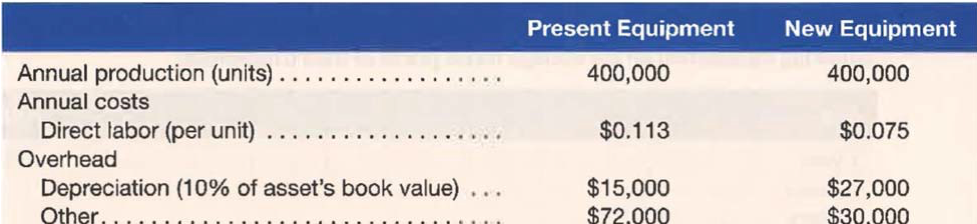

The management of Kangaroo Manufacturing Company is currently evaluating a proposal to purchase a new, innovative drill press as a replacement for a less efficient piece of similar equipment, which would then be sold. The cost of the equipment, including delivery and installation, is $270,000. If the equipment is purchased, Dusseldorf will incur a $7,500 cost in removing the present equipment and revamping service facilities. The present equipment has a book value of $150,000 and a remaining useful life of ten years. Because of new technical improvements that have made the present equipment obsolete, it now has a disposal value of only $60,000. Management has provided the following comparison of manufacturing costs:

Additional information follows:

• Management believes that if the current equipment is not replaced now, it will have to wait ten years before replacement is justifiable.

• Both pieces of equipment are expected to have a negligible salvage value at the end of ten years.

• Management expects to sell the entire annual production of 400,000 units.

• The company’s cost of capital is 12 percent.

Required: In Excel, using differential cash flow, evaluate the desirability of purchasing the new equipment.

Solution:

| Computation of Annual cash saving on new equipment | |

| Particulars | Amount |

| Saving in direct labor cost [($0.113-$0.075)*400000) | $15,200.00 |

| Others ($72,000 – $30,000) | $42,000.00 |

| Net Annual Saving | $57,200.00 |

| Computation of NPV – Replacement proposal of equipment – Kangaroo Manufacturing Company | ||||

| Particulars | Period | Amount | PV Factor | Present Value |

| Cash Outflows: | ||||

| Cost of new equipment | 0 | $270,000 | 1 | $270,000 |

| Cost of removing present equipment | 0 | $7,500 | 1 | $7,500 |

| Sale value of old equipment | 0 | -$60,000 | 1 | -$60,000 |

| Present value of cash outflows (A) | $217,500 | |||

| Cash Inflows: | ||||

| Annual cost savings | 1-10 | $57,200 | 5.65022 | $323,193 |

| Present value of cash Inflows (B) | $323,193 | |||

| NPV (B-A) | $105,693 | |||

As NPV for replacement proposal is positive, therefore old equipment should be replaced with new equipment.